掃碼下載APP

及時接收考試資訊及

備考信息

Rates of tax

IHT is payable once a person’s cumulative chargeable transfers over a seven-year period exceed a nil rate band. For the tax year 2012–13 the nil rate band is £325,000, and for previous years it has been as follows:

The rate of IHT payable as a result of a person’s death is 40%. This is the rate that is charged on a person’s estate at death, on PETs that become chargeable as a result of death within seven years, and is also the rate used to see if any additional tax is payable on CLTs made within seven years of death.

The rate of IHT payable on CLTs at the time they are made is 20% (half the death rate). This is the lifetime rate.

The tax rates information that will be given in the tax rates and allowances section of the June and December 2013 exam papers is as follows:

Where nil rate bands are required for previous years then these will be given to you within the question.

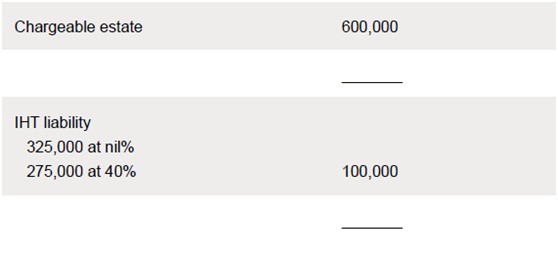

Example 4

Sophie died on 26 May 2012 leaving an estate valued at £600,000.

The IHT liability is as follows:

Death estate

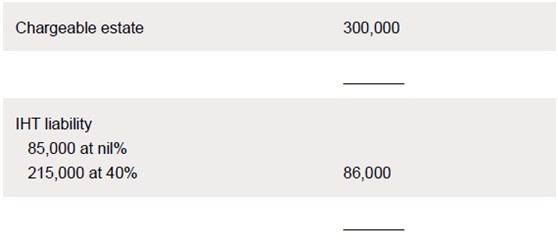

Example 5

Ming died on 22 April 2012 leaving an estate valued at £300,000.

On 30 April 2010 she had made a gift of £240,000 to her son. This figure is after deducting available exemptions.

IHT liabilities are as follows:

Lifetime transfer – 30 April 2010

· Only £85,000 (325,000 – 240,000) of the nil rate band is available against the death estate.

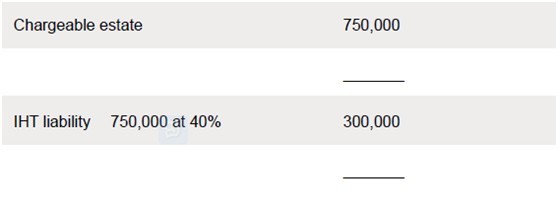

Example 6

Joe died on 13 October 2012 leaving an estate valued at £750,000.

On 12 November 2009 he had made a gift of £400,000 to a trust. This figure is after deducting available exemptions. The trust paid the IHT arising from the gift.

The nil rate band for the tax year 2009–10 is £325,000.

Lifetime transfer – 12 November 2009

· The gift to a trust is a CLT. The lifetime IHT liability is calculated using the nil rate band for 2009–10.

Additional liability arising on death – 12 November 2009

· The additional liability arising on death is calculated using the nil rate band for 2012–13.

Death estate

· The CLT made on 12 November 2008 has fully utilised the nil rate band of £325,000.

Page:1 2 See the original>>

Copyright © 2000 - www.sgjweuf.cn All Rights Reserved. 北京正保會計科技有限公司 版權所有

京B2-20200959 京ICP備20012371號-7 出版物經營許可證 ![]() 京公網安備 11010802044457號

京公網安備 11010802044457號

套餐D大額券

¥

去使用 主站蜘蛛池模板: 亚洲男人在线天堂| 亚洲人成亚洲人成在线观看| 鲁大师在线视频播放免费观看| 看亚洲黄色不在线网占| 欧洲精品一区二区三区久久| 毛片大全真人在线| 精品无码日韩国产不卡av | 国产精品伦人一久二久三久 | 人人妻人人澡人人爽不卡视频| 精品久久8x国产免费观看| 国产精品疯狂输出jk草莓视频| 亚洲一区二区三区日本久久| 国产在线中文字幕精品| 无码一区中文字幕| 国产资源精品中文字幕| av无码精品一区二区乱子 | 国产999久久高清免费观看| 精品无码成人片一区二区| 国产精品综合av一区二区国产馆 | 麻豆国产传媒精品视频| 国产无套精品一区二区三区 | 亚洲av一本二本三本| 国产精品一线天在线播放| 鄂托克旗| 内射视频福利在线观看| 久久亚洲日本激情战少妇| 色综合热无码热国产| 亚洲欧美成人aⅴ在线| 精品国产高清中文字幕| 蜜臀98精品国产免费观看 | 国产福利片无码区在线观看| 精品国产一区二区三区大 | 丁香花在线影院观看在线播放| 午夜DY888国产精品影院| 亚洲欧美日本久久网站| 亚洲成人四虎在线播放| 日本三级香港三级三级人!妇久| 免费观看全黄做爰大片| 永定县| 亚洲国产激情一区二区三区 | 白白发布视频一区二区视频|